Parallel Ledger and Extension Ledger in SAP S/4HANA

Parallel Accounting with the new parallel ledger and functionalities of extension ledger in SAP S/4HANA

Group companies may have different accounting standards (group accounting standards, local accounting standards and tax accounting standards) and must be able to represent these. In former SAP versions, there were different approaches to meet these requirements.

With the implementation of SAP S/4HANA, it is possible to map parallel accounting in General Ledger Accounting by maintaining several parallel ledgers according to different accounting principles. For the financial statements, the relevant accounting principles are mapped in the leading ledger or the local ledgers. A ledger is a centralized collection of accounting data. In addition to parallel ledgers, extension ledgers are also introduced as a new feature in S/4HANA. Extension ledgers offer functionalities that can be used for management reporting to adjust or add data in spreading the standard ledgers without editing the data from the underlying ledgers. The different approaches in former SAP versions as well as the advantages of the solution approach in the new SAP S/4HANA are presented below.

Ledger in former SAP versions

In former SAP versions, a distinction is made between standard ledgers and special ledgers. The standard ledgers are configured and delivered by SAP and processed in the individual applications. Standard ledgers are the general ledger, the consolidation ledger, the profit center ledger and the reconciliation ledger. Special Purpose Ledgers are defined as ledgers that meet specific business and organizational requirements. Special ledgers can be managed with any account assignment terms as general ledgers or sub-ledgers. Account assignment terms can be SAP dimensions from the various applications, for example cost centre or business area and can be own dimensions such as region.

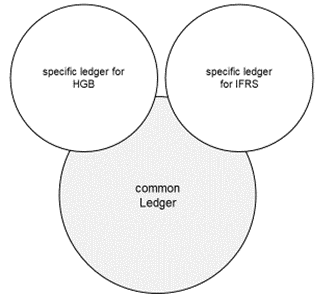

Also, in former SAP systems, there is no standard technology to fulfil the requirements of parallel accounting. For this reason, companies had to use other approaches. SAP offers three solution approaches for parallel accounting: The account solution, ledger solution and company code solution. Most companies have used the account solution, also known as the “Mickey Mouse solution”. For items to be recognized differently under IFRS than under HGB, identical ID numbers are defined with an I or H as a prefix, as well as a common account without a prefix in each case, for example, for the item “Christmas bonus,” an HGB account H222, an IFRS account I222, and a common account 222. Items for which the valuation under IFRS does not change are only assigned the common ID number. Those items that are calculated and valued differently under IFRS and HGB appear in two balance sheets. In an HGB balance sheet via the HGB and common accounts, and in an IFRS balance sheet via the IFRS and common accounts. The joint accounts therefore appear in both sets of financial statements, the HGB accounts only in the HGB balance sheet and the IFRS accounts only in the IFRS balance sheet.

Figure 1: Account solution “Mickey Mouse”

For each account it has to be specified whether it may only be accounted according to IFRS, according to HGB or according to both guidelines. If only a manageable number of accounting methods are involved, parallel accounting can be implemented in a structured way. However, as soon as a high number of accounting methods or valuation differences are involved, implementation would become more complicated and time-consuming due to the increased number of accounts.

If the Mickey Mouse method is not suitable, there are two further approaches in SAP ECC possible. For customers with a very large number of accounts with valuation differences, the ledger solution makes more sense. This solution requires customers to set up a type of second general ledger in the SAP R/3 component Financials-Special Ledger (FI-SL), in which they make the standardizing entries for parallel accounting. Finally, the company code solution enables users to represent another depreciation area in Asset Accounting in a separate company code. However, this solution cannot be integrated into the Controlling (CO) component and is not being further developed by SAP.

In SAP S/4HANA, a distinction is made between different types of ledgers

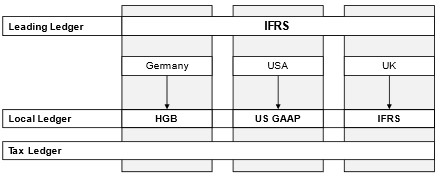

To be able to keep several parallel general ledgers in general ledger accounting, for example to balance according to several accounting principles, a ledger is created for each of the legal requirements. At group level, for example, a company prepares its accounts for all company codes in accordance with IFRS in a so-called leading ledger, while the individual company codes prepare their accounts in compliance with their local accounting standards, e.g. US GAAP or HGB, in the non-leading ledger.

Leading Ledger

In the standard S/4HANA system, ledger 0L is the leading ledger and exactly one ledger must be identified as such. This ledger is updated in all company codes and the settings (currency, transaction variant, etc.) are transferred for each company code. The leading ledger is integrated with Controlling and thus forms the basis for the actual value flows in Controlling and contains the complete set of line items in table ACDOCA. Each company code must be assigned to a standard ledger and each of these ledgers must belong to a ledger group. The ledger group includes any number of ledgers. The leading ledger would automatically also be the so-called representative ledger in the ledger group. From the representative ledger in a group, the posting periods are determined for all other ledgers in the same group. In addition, the assignment to a ledger group means that the same functions and processes in General Ledger Accounting apply to all ledgers within the group. In the above example, the company prepares a leading ledger that is managed in accordance with IFRS financial reporting framework.

In the leading ledger, currently there is only the option to display a single valuation view, which accounts then for all company codes. Moreover, the complete controlling value flows are valued according to the valuation of the leading ledger. If, for example, the company is working with imputed costs, then it is not possible to simultaneously draw a pure IFRS view through the value flows in Controlling (CO), Product Costing (CO-PC) and Margin Analysis (CO-PA). But for future S/4HANA versions SAP is working on Universal Valuation functionality, which should enable several valuations also on leading ledger level.

Non-leading Ledger (parallel Ledger)

The non-leading ledgers can exist alongside the leading ledger and are managed as parallel ledgers based on local accounting principles, for example. In SAP, postings can be made to the parallel ledgers from various application components, such as Financial Accounting (FI), Asset Accounting (FI-AA), or Controlling (CO). A posting can be made to all ledgers, to multiple ledgers, or to a single ledger. For an additional parallel accounting rule, another non-leading ledger can be created in the general ledger. These ledgers must be activated for each company code and receive the complete set of line items in table ACDOCA.

Figure 2: Parallel accounting in SAP S/4HANA

To display the different valuation areas per accounting principle – and thus per ledger – each ledger must be assigned to its own ledger group.

The advantage for parallel accounting in SAP S/4HANA is the manageable number of G/L accounts, since a separate ledger is maintained for each accounting standard (IFRS, HGB, etc.). Thus, different business variants can be mapped with this solution approach. In addition, separate reconciliation of Asset Accounting with the General Ledger is no longer required, since all acquisition postings generated by the system are posted directly to the General Ledger (to the same ACDOCA table).

Extension Ledger

In addition to the standard ledgers, SAP S/4HANA offers extension ledgers as a new function. Extension ledgers are created with reference to an underlying ledger. There are three possibilities to use these ledgers. The first possibility is the type “extension ledger”. Here, no full scope of all posting records can be made, but only additional postings. Only manual postings are possible. The extension ledger can therefore be used for manual supplementary postings from Controlling to the Financial Accounting module e.g., if the posting month or fiscal year has already been completed in the standard ledger and the posting periods there are already closed. These postings are also only visible in the extension ledger, but not in the standard ledger. Reports, however, access the data from both ledgers by linking the extension and standard ledgers and can thus display all data. In extension ledgers, posting periods can be opened and closed independently of the underlying standard ledger.

In addition, there are two other extension ledger types for different applications. The extension ledger type “simulation” is an extension ledger and works similarly to a “test mode” run, though there is a document inside table ACDOCA and therefore, it is later possible to analyze that data in reports. This ledger type is used to apply simulation functions for example as foreign currency valuation. The last extension ledger type “prediction and commitment” allows posting sales orders (before delivery or billing) in the Universal Journal, to support sales and profitability forecasting (which is traditionally done in costing-based Profitability Analysis using record type A). This ledger can also be used for purchase order commitment management.

Extension ledgers are an important feature that can be used for management reporting purposes. Thereby the most important advantage is that they can help to bring the data to the top of the standard ledgers without having to edit the data from the underlying ledgers.

If you want to get more information on Parallel Ledger and Extension Ledger in SAP S/4HANA, feel free to contact Andy Draxinger (andy.draxinger@www.draxingerlentz.de).