Harmonization of strategy, control and ERP

Gain control efficiency through consistent mapping of your strategy in the processes and in the ERP system.

Successfully design your strategy implementation with Draxinger & Lentz.

Harmonization of strategy, control and ERP

Gain control efficiency through consistent mapping of your strategy in the processes and in the ERP system.

Successfully design your strategy implementation with Draxinger & Lentz.

Contribution of the finance department in strategy implementation

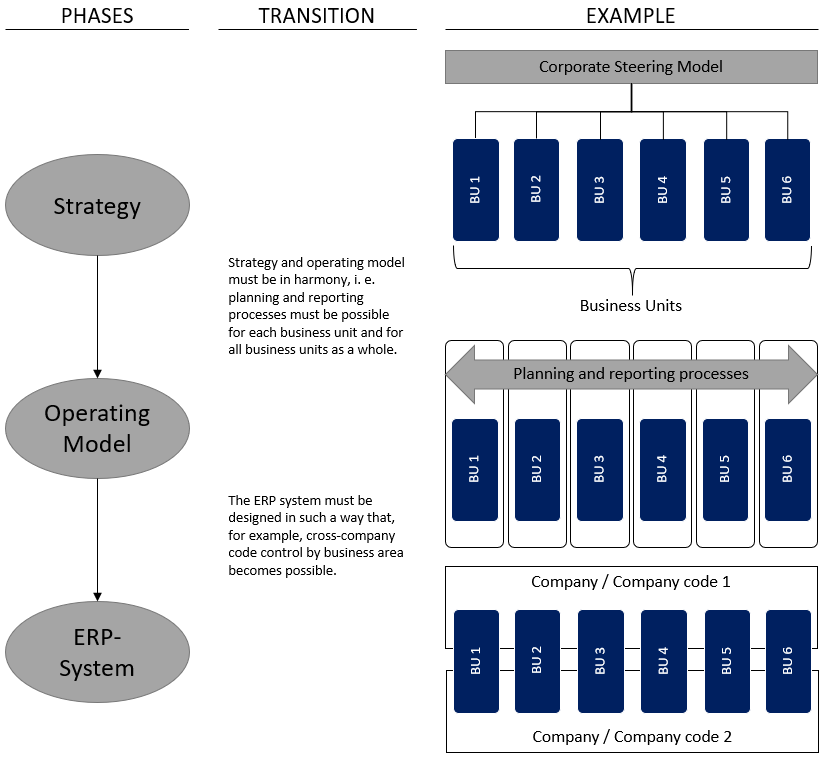

Strategy implementations place enterprises before large challenges. The finance department should allocate the company’s resources in line with the strategy and provide the necessary data for the entire company. Due to inconsistent strategy mapping in the processes and in the ERP system, this is often associated with a high level of manual effort. As a result, the efficient creation as well as the quality and verifiability of control-relevant data suffers.

Harmonizing the financial control system with the strategy is complex and abstract. Nevertheless, this harmonization is a necessary prerequisite to ensure effective control of your company. Draxinger & Lentz supports you with the necessary strategic, professional and technical know-how.

Our approach for your strategy harmonization

Phase 1: Strategy decoding

Successful strategy implementation requires a control system that is aligned with the strategy. For this purpose, the strategy is analyzed in the first phase in order to extract the necessary information for the definition of the operating model.

Phase 2: Definition of the Operating Model

The Operating Model forms the interface between the strategic and the operational level. Using the information from the first phase, the Operating Model is aligned with the strategy. The focus is on the activities and processes for service delivery.

Phase 3: Analysis and derivation of the Process Model

In conjunction with the Operating Model, the core processes of your company are analyzed. Based on this, we derive the design of the key control dimensions (e.g. KPI, structures) and financial processes (e.g. planning, financial statements, reporting) – and thus ensure that your finance organization operates in line with your strategy.

Phase 4: Definition of the ERP- and BI-structures

Your ERP system can be structured on this basis in line with your strategy so that it optimally supports the control model and financial processes and thus efficiently provides the information required for control.

An example of our work for clients

One of our customers from the energy industry wanted to align its corporate management along strategic business units. However, the ERP system could not map the information required for this, as management responsibility extended beyond the boundaries of the legal units.

For successful strategy implementation, the control system needed to map the strategy. Thus, we first supported the customer in transferring the strategy into an operating model. This made the corporate structure with its core processes visible. The necessary adjustments in the processes and in the system could be identified and, on the basis of this, a detailed project plan could be drawn up for the customer. In order to obtain the desired control-relevant information, a transformation of the ERP system also had to take place.

The customer wanted ERP functionality and structure that would allow control, planning and reporting per business unit. To ensure this, we worked out and coordinated the structures together with the business unit managers. As a result, profit center accounting was introduced on the basis of the business units as a link between financial accounting and controlling.

Get in touch for more information

We would be happy to discuss an initiative to harmonize strategy, control and ERP with you on a non-binding basis.

Draxinger & Lentz supports you in your initiative, from the decoding of your strategy to the definition of the operating model and the central financial processes, to the structuring and implementation in your ERP system.

Read further insights on this topic from our Blog