Working Capital Management in today’s economy

Effective working capital management is a cornerstone of financial stability and operational efficiency for businesses across industries. It plays a pivotal role in maintaining the delicate balance between short-term obligations and operational requirements. In the present economic landscape, characterized by its intricacies and uncertainties, the strategic management of working capital assumes heightened importance. Working capital, defined as the disparity between current assets and liabilities, represents a fundamental financial metric for enterprises. It encapsulates the resources necessary for daily operations, encompassing components like inventory, accounts receivable, and accounts payable. Effective working capital management is instrumental in optimizing the utilization of these resources, ensuring the smooth execution of operational activities, and facilitating adherence to financial obligations. Beyond its numerical significance, proficient working capital management is indicative of an organization’s adeptness in balancing liquidity, profitability, and operational efficiency. This equilibrium is particularly pertinent in a contemporary economic milieu where volatility and unpredictability often govern decision-making.

The current economic landscape is marked by a confluence of opportunities and challenges that necessitate astute financial strategies. Globalization, rapid technological advancements, and evolving consumer preferences have engendered a business environment characterized by fluidity and dynamism. Simultaneously, the recent disruptions, including supply chain constraints and economic contractions, underscore the exigency of robust working capital management practices. The COVID-19 pandemic, for instance, has accentuated the importance of resilient financial structures that can endure unforeseen shocks and ensure business continuity.

Understanding the Cash Conversion Cycle

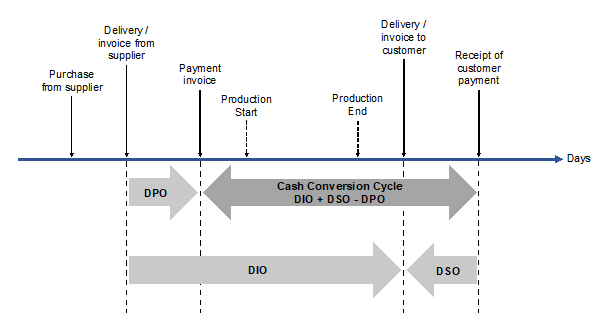

To effectively manage working capital in today’s economic situation, it is essential to grasp the concept of the Cash Conversion Cycle (CCC). The CCC represents the time it takes for a company to convert its investments in inventory into cash. It consists of three key components:

- Days Inventory Outstanding (DIO) measures the average number of days it takes for a company to sell its inventory. A shorter DIO indicates better inventory management and a more efficient use of working capital.

- Days Sales Outstanding (DSO) measures the average number of days it takes for a company to collect payment from its customers after a sale. A shorter DSO accelerates cash inflows, improving liquidity.

- Days Payable Outstanding (DPO) represents the average number of days it takes for a company to pay its suppliers. Extending the DPO can help preserve cash for longer periods.

Efficiently managing these components of the CCC can significantly impact a company’s working capital. By reducing DIO and DSO while extending DPO, a company can free up cash that can be used for essential business operations or strategic investments. In today’s economic situation, where cash flow management is paramount, optimizing the CCC is a key strategy to maintain financial stability.

Lessons Learned from Supply Shortages

The recent wave of supply shortages, exacerbated by disruptions in global supply chains, has underscored the importance of robust working capital management. Supply shortages can lead to increased procurement costs, delayed production, and reduced sales, all of which have a direct impact on working capital. Companies that fail to adapt to these supply chain challenges can find themselves in a precarious financial position.

To navigate supply shortages and other economic uncertainties, businesses must implement strategies to mitigate risks and safeguard their liquidity. These strategies may include diversifying suppliers, maintaining safety stock levels, renegotiating payment terms with suppliers, and optimizing production schedules to minimize inventory holding costs. By proactively addressing supply chain risks, companies can better manage their working capital and ensure their financial resilience in today’s economic landscape.

Financing costs are becoming more expensive due to rising interest rates. What is the effect on Working Capital Management?

In today’s economic landscape, one significant development is the upward trajectory of interest rates. As interest rates rise, businesses face increased financing costs, which directly impact working capital management. The effect of rising interest rates on working capital can be multifaceted:

- Increased Borrowing Costs: Businesses that rely on loans or lines of credit to finance their operations may experience higher interest expenses. This places additional pressure on working capital, as a larger portion of cash inflows may need to be allocated to servicing debt.

- Impact on Cash Flow: Higher interest payments can reduce a company’s cash flow, potentially affecting its ability to meet short-term obligations. This underscores the importance of optimizing working capital to ensure sufficient liquidity to cover debt obligations.

- Capital Allocation: Rising interest rates may prompt companies to reassess their capital allocation strategies. Businesses may prioritize debt reduction to lower interest expenses, which can influence working capital management decisions.

To effectively manage working capital in an environment of rising interest rates, companies must strike a balance between optimizing liquidity and addressing debt service obligations.

Designing Effective Liquidity Management

Liquidity management is a cornerstone of effective working capital management and cash flow stability. Maintaining adequate liquidity ensures that a company can meet its short-term financial commitments, seize opportunities, and weather unforeseen financial challenges. In today’s economic climate, characterized by uncertainty and fluctuating market conditions, liquidity management takes on heightened significance.

To optimize liquidity and support working capital management, businesses can employ various techniques and best practices:

- Cash Reserves: Maintaining a prudent level of cash reserves is essential to cover immediate financial needs. Companies should regularly review and adjust these reserves based on changing economic conditions.

- Working Capital Analysis: Conducting a comprehensive analysis of working capital components, such as inventory levels and accounts receivable, enables businesses to identify areas for improvement and unlock trapped cash.

- Cash Flow Forecasting: Accurate cash flow forecasting helps anticipate cash surpluses or shortfalls, enabling proactive decision-making. Utilizing technology and financial modeling tools can enhance the accuracy of cash flow projections.

Interlocking of key processes

Efficient working capital management involves the interlocking of key processes within an organization. Three critical processes that significantly impact working capital are inventory management, accounts receivable management, and supplier management:

- Inventory Management: Maintaining an optimal level of inventory minimizes holding costs and maximizes cash flow. Just-in-time inventory systems and demand forecasting techniques are instrumental in achieving this balance.

- Accounts Receivable Management: Timely collection of accounts receivable is crucial for cash flow. Implementing credit policies, monitoring payment terms, and employing collections strategies are key elements of effective accounts receivable management.

- Supplier Management: Collaborating with suppliers to negotiate favorable terms, extend payment schedules, and explore supply chain efficiencies can contribute to working capital optimization.

By aligning these processes and optimizing their performance, businesses can enhance working capital management and ensure that cash is efficiently utilized throughout the organization.

Cash Flow Forecasting, Planning, and Capital Structure Management

Accurate cash flow forecasting and strategic capital structure management are pivotal aspects of modern working capital optimization. In today’s dynamic economic environment, where financial stability is paramount, businesses must rely on precise forecasts to make informed decisions. This chapter explores the interplay between cash flow forecasting and capital structure management, shedding light on their role in working capital efficiency.

A. The Role of Accurate Cash Flow Forecasting

Accurate cash flow forecasting serves several critical purposes in the realm of working capital management:

- Risk Mitigation: Anticipating cash flow shortfalls enables businesses to proactively identify and mitigate potential risks, such as liquidity shortages or missed debt payments. By having a clear picture of future cash inflows and outflows, companies can make informed decisions to safeguard their financial stability.

- Operational Efficiency: Aligning cash flow forecasts with operational plans empowers companies to optimize their working capital allocation and investment decisions. This synergy between forecasting and operations ensures that available cash resources are utilized efficiently, whether for funding growth initiatives or managing day-to-day expenses.

B. Capital Structure Management: Cost Control and Balancing Debt-Equity Dynamics

Effective capital structure management complements cash flow forecasting by influencing working capital availability and long-term financial stability. This section explores the various facets of capital structure management, including cost control and the impact of financing decisions.

- Cost Management and Controlling: To optimize working capital, companies should prioritize cost management and control. Reducing unnecessary expenses, streamlining processes, and identifying cost-saving opportunities are essential steps to free up cash for essential operations. These efforts not only enhance financial stability but also contribute to profitability.

- Impact of Capital Structure Decisions on Working Capital: The composition of a company’s capital structure, encompassing the mix of debt and equity, plays a pivotal role in determining working capital availability. While leveraging debt can provide a valuable source of financing, it may also increase interest expenses, affecting cash flow. Companies must meticulously assess their capital structure decisions to strike the right balance between debt and equity, aligning their financing choices with working capital needs.

C. Balancing Debt and Equity for Optimal Working Capital and Cash Flow

Balancing debt and equity in a manner that aligns with working capital objectives is a strategic imperative. To achieve this balance, companies should consider their long-term financial goals, risk tolerance, and prevailing market conditions when making capital structure decisions. By proactively aligning their financing choices with working capital requirements, businesses can position themselves for financial stability and sustainable growth in today’s ever-evolving economic landscape.

Navigating the Current Economic Landscape: The Imperative of Effective Working Capital Management

In conclusion, effective working capital management is a vital component of financial stability and operational efficiency in today’s complex economic environment. It enables businesses to strike a delicate balance between short-term obligations and operational needs. The current economic landscape presents both opportunities and challenges, underscoring the importance of robust working capital practices. Understanding the Cash Conversion Cycle (CCC) is crucial, as it directly impacts working capital by optimizing components like Days Inventory Outstanding (DIO), Days Sales Outstanding (DSO), and Days Payable Outstanding (DPO). Rising interest rates add complexity to working capital management, necessitating a careful balance between liquidity and debt service obligations. Accurate cash flow forecasting and strategic capital structure management are essential tools for optimizing working capital. These practices empower businesses to mitigate risks, enhance operational efficiency, and achieve the right balance between debt and equity financing.

In today’s dynamic economic landscape, proficient working capital management is not just financially essential but also strategically advantageous. It positions businesses for long-term success and resilience in a volatile and unpredictable environment.

If you want to get more information on Working Capital Management in today’s economy, feel free to contact Fabian Winckler (fabian.winckler@www.draxingerlentz.de)