The impact of AI in Controlling and Financial Processes

Artificial intelligence (AI) has revolutionized controlling and finance processes, reshaping tasks and roles in the financial sector. The integration of AI technologies, such as powerful conversational tools like ChatGPT, has automated tasks, improved decision-making, and enhanced customer interactions. This transformation brings both advantages and limitations that require careful consideration. Additionally, the finance industry is facing a shortage of skilled workers, making it challenging to find individuals with the right expertise. This shortage calls for alternative solutions that empower existing professionals, augment their capabilities, and streamline their workflows. The implementation of AI in controlling and financial processes presents an opportunity to address these challenges and unlock new possibilities for efficiency, productivity, and innovation.

As AI technologies continue to advance, they have the potential to automate numerous routine and repetitive tasks that were traditionally performed by human professionals. This includes activities such as data entry, reconciliations, and routine calculations. With AI taking over these manual tasks, professionals in controlling and finance are able to shift their focus towards more strategic and value-added activities.

However, as traditional roles undergo transformation, it is crucial for professionals to adapt and develop new skills to effectively collaborate with AI technologies. This includes acquiring expertise in data analysis, AI interpretation, and strategic thinking. By working in tandem with AI systems, professionals can leverage the capabilities of these technologies to enhance their own expertise and decision-making. The integration of AI in controlling and financial processes opens up new possibilities for professionals to engage in more complex, strategic, and value-driven tasks, ultimately contributing to the overall success of controlling and financial operations.

Advantages of AI integration

AI brings numerous advantages for controlling and finance processes. One key benefit is the potential to improve accuracy. AI systems are able to accurately process vast amounts of data and detect patterns and anomalies that may go unnoticed by human analysts. This leads to more accurate financial analyses, forecasts, risk assessments and decisions. For example, the probability of human error decreases, which positively influences the reliability of controlling and financial processes.

Implementing AI in controlling and financial processes offers key advantages of scalability and adaptability: Scalability allows organizations to efficiently handle growing volumes of financial data, ensuring smooth processing and analysis even during peak periods or high-demand scenarios. AI systems dynamically allocate computing resources to meet workload fluctuations, maintaining operational efficiency.

Adaptability empowers organizations to adapt to changing business needs, regulatory requirements, and technological advancements. AI integration enables seamless incorporation of new rules, industry practices, and emerging technologies into financial processes, ensuring compliance and driving innovation.

Potential Challenges and Limitations

One of the primary risks of implementing AI in controlling and financial processes is the heavy reliance on accurate and high-quality data. AI systems require clean, reliable, and unbiased data to generate meaningful insights and make informed decisions. If the input data is incomplete, inconsistent, or contains biases, it can lead to erroneous outcomes and flawed decision-making. Organizations must invest in robust data quality management processes, including data cleansing, normalization, and ongoing monitoring, to mitigate the risks associated with poor data quality.

Additionally, the interpretation of AI-generated results can be challenging due to the complexity of algorithms and lack of transparency in some models. Organizations must exercise critical judgment and validate the outcomes to ensure accurate decision-making. Lastly, while AI offers powerful capabilities, it is important to avoid venturing beyond the organization’s core competence. Understanding the limitations of AI and maintaining human expertise in areas requiring contextual understanding and judgment is essential for effective and responsible integration in controlling and financial processes.

AI systems may lack contextual understanding, hindering accurate interpretation and decision-making in specific situations. To overcome this challenge, organizations should combine AI-driven insights with human expertise. This ensures a comprehensive understanding of the context and enables well-informed decisions in controlling and financial processes.

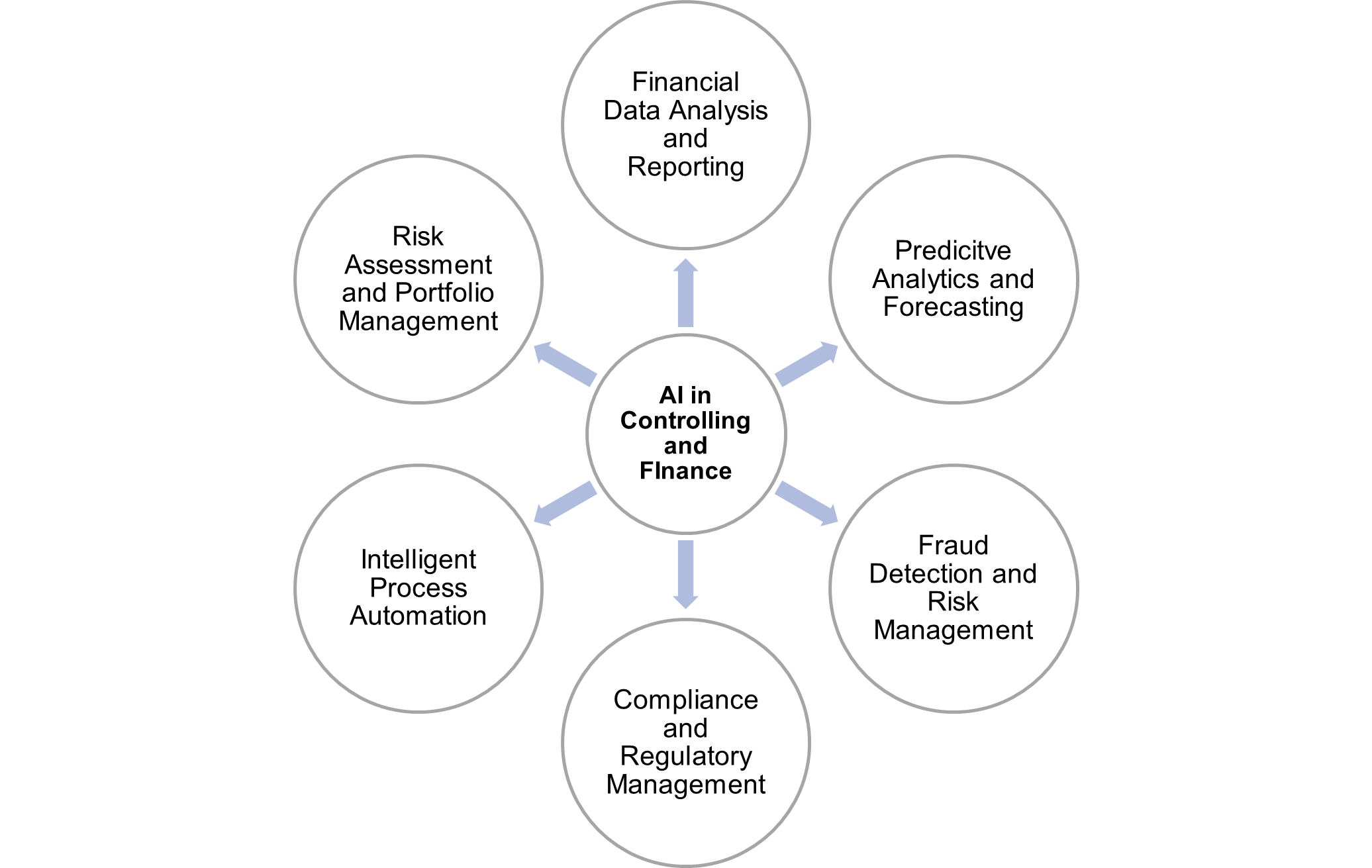

AI Applications in Controlling and Financial Processes

The integration of AI technology offers numerous opportunities for enhancing controlling and financial processes. Let’s delve into more detail on the specific areas where AI can be applied:

Financial Data Analysis and Reporting:

AI algorithms can analyze large volumes of financial data, extracting valuable insights and patterns. By automating data processing tasks such as data entry, data cleansing, and data reconciliation, AI streamlines the financial reporting process. It can identify anomalies, outliers, and trends in the data, enabling more accurate and timely financial reporting. AI-powered reporting tools can generate comprehensive reports with visualizations, making it easier for stakeholders to interpret and understand the financial information.

Predictive Analytics and Forecasting:

AI plays a crucial role in predictive analytics and forecasting within controlling and financial processes. By leveraging historical financial data and considering various external factors, such as market trends, economic indicators, and business variables, AI models can generate accurate forecasts. These forecasts support budgeting processes, strategic planning, and risk assessment. AI algorithms can identify patterns and relationships in the data that may not be readily apparent to human analysts, enabling organizations to make data-driven decisions and anticipate future financial outcomes.

Fraud Detection and Risk Management:

AI is instrumental in detecting fraudulent activities and managing financial risks. By analyzing large volumes of transactional data, AI models can identify unusual patterns, detect anomalies, and flag potentially fraudulent transactions. Machine learning algorithms can continuously learn and adapt to evolving fraud patterns, enhancing the effectiveness of fraud detection systems. AI can also contribute to risk management by identifying areas of potential financial risk, such as credit default, market fluctuations, or compliance breaches, allowing organizations to take proactive measures to mitigate those risks.

Compliance and Regulatory Management:

AI technologies can aid organizations in ensuring compliance with regulatory requirements. AI systems can analyze financial transactions, detect suspicious activities, and identify compliance risks. By automating compliance monitoring processes, AI can provide real-time alerts or recommendations to ensure adherence to legal and regulatory standards. This reduces the risk of non-compliance and helps organizations maintain a strong ethical and legal standing in their financial operations.

Intelligent Process Automation:

AI-powered automation is transforming controlling and financial processes by streamlining repetitive and time-consuming tasks. AI systems can automate data entry, perform reconciliations, and carry out routine calculations with a high degree of accuracy. This enables professionals to focus on more strategic and value-added activities, such as data analysis, decision-making, and financial strategy development. By automating manual tasks, AI enhances efficiency, reduces errors, and frees up valuable human resources to focus on tasks that require creativity and critical thinking.

Risk Assessment and Portfolio Management:

AI technologies are increasingly used for risk assessment and portfolio management in the financial industry. AI models can analyze market data, evaluate investment risks, and provide insights for optimizing investment strategies. By considering multiple factors, such as historical performance, market trends, and risk indicators, AI algorithms can assist in portfolio construction and rebalancing. This empowers financial professionals to make data-driven investment decisions, manage risks effectively, and maximize returns for clients.

By leveraging AI in these specific areas, organizations can unlock new levels of efficiency, accuracy, and decision-making capabilities in their controlling and financial processes, leading to improved financial performance and a competitive edge in the industry.

Collaborative Potential between employees and AI-Systems

In the realm of controlling and financial processes, the collaborative potential between humans and AI systems opens up exciting possibilities. By combining the unique strengths of both, organizations can achieve remarkable outcomes.

In another example, consider the role of AI in financial reporting. AI-powered tools can automate the generation of financial reports, ensuring accuracy, consistency, and timeliness. Professionals can focus their attention on reviewing and interpreting the reports, using their expertise to analyze the data within the broader context of the organization’s goals and strategies. AI systems complement their work by streamlining the reporting process, reducing errors, and providing a solid foundation of reliable data.

Collaboration between humans and AI systems also extends to budgeting and forecasting processes. AI technologies can analyze historical financial data, market trends, and external factors to generate accurate forecasts. Professionals can then use these forecasts as a basis for strategic decision-making, adapting the organization’s financial plans to align with changing market conditions. This collaboration empowers professionals to make data-driven decisions with greater confidence, positioning the organization for success.

It’s worth noting that AI systems do not replace human professionals, but rather enhance their capabilities. Professionals bring their expertise, intuition, and contextual understanding to the table, ensuring that AI-generated insights are interpreted correctly and aligned with organizational goals. The collaborative potential between humans and AI systems allows organizations to harness the power of data-driven insights while leveraging the unique skills and judgment of their human workforce.

Summarizing the impact of AI in Controlling and Financial Processes

In conclusion, the integration of AI in controlling and financial processes holds tremendous potential for driving efficiency, accuracy, and innovation. By automating routine tasks and providing advanced data analysis capabilities, AI technologies empower professionals to focus on strategic activities that require their expertise. The advantages of AI integration include improved productivity, enhanced decision-making, and scalability. However, it is crucial to address challenges such as data quality, interpretation of AI-generated results, and the importance of maintaining human expertise. Collaborative potential between humans and AI systems allows for remarkable outcomes, combining the strengths of both to achieve data-driven insights and informed decision-making. With a positive outlook on AI, organizations can embrace its transformative power and unlock new possibilities for success in controlling and financial processes.

If you want to get more information on the impact of AI in Controlling and Financial Processes, feel free to contact Fabian Winckler (fabian.winckler@www.draxingerlentz.de)