Startup Controlling

Controlling in Startups

Studies show that start-ups which setup appropriate controlling structures early on are more likely to succeed and grow in a more structured way. However, simply transferring what works in established corporations is neither effective nor efficient in the context of a start-up. Start-ups differ significantly from established companies, especially in terms of their organizational and operational structure, flexibility, financial resources, and decision-making speed. Due to these structural differences, a transfer of classic controlling approaches is only possible to a limited extent – yet, setting some form of controlling structures up is one of the most important functions to establish early on in a company’s life. Controlling in start-ups should be applied with a sense of proportion and in interaction with the corporate objectives during the founding and growth phase. The controlling should grow and be continuously expanded, just like the company itself. Less financially strong start-ups will initially be unable to afford either an internal controlling position or the outsourcing of controlling. Therefore, the founders themselves usually take over this position, which is why controlling must meet various requirements to not be a burden but an enrichment for the founder(s). An efficient controlling system ensures rational decision making for the management and accelerates the dynamics and flexibility that characterizes start-ups. Based on that controlling system, the team must be able to gain valuable insights from available data, react quickly to these insights and have a reliable decision-making basis. Based on these information, rational behavior and the appropriate induction of measures can be ensured. At the latest when external funding is needed, internal and external controlling and reporting requirements should be coordinated in an appropriate manner.

Implement adequate controlling tools depending on the phase of the start up

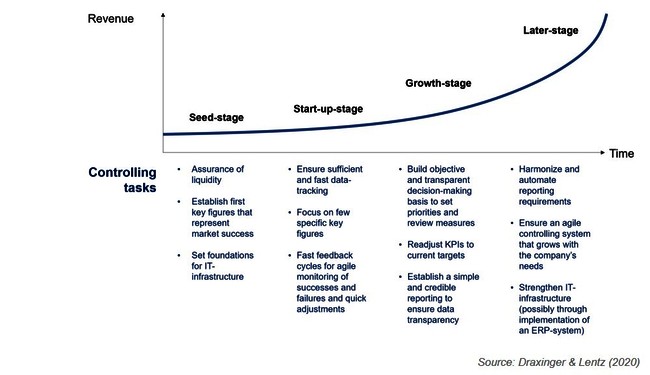

The requirements for controlling differ depending on the stage of the start-up. We illustrate the different requirements using four stages that a start-up typically goes through: seed-stage, start-up-stage, growth-stage, and later-stage. Nevertheless, these requirements cannot be strictly generalized to one phase. Some tools may be useful for certain start-ups earlier and for others in later phases. An adequate analysis depending on the company situation is therefore crucial. For example, the implementation of a professional ERP-system for E-Commerce start-ups that rely on multichannel is essential right from the start to provide a real-time overview of inventory levels, accounting, and company performance while that might not be necessary for a start-up in another sector.

Seed Stage

The life cycle begins with the seed-stage, in which start-ups develop their business concept and no revenues have yet been generated. The first stage of a start-up is the riskiest for both founders and investors due to the uncertainty of the success of the business idea. During the seed stage, the primary goal is the successful implementation of the business idea. To achieve this goal, the focus from a controlling perspective is on the tasks of planning, financing, and ongoing liquidity assurance. However, the formal and organizational structure of the company must also be promoted. Thus, despite financial restrictions, lack of experience and limited personnel resources, an efficient corporate steering must be ensured. Furthermore, it can be a competitive advantage to build up an IT infrastructure that holds the essential data right from the beginning. This makes sure that all important data is collected, structured and can be analyzed. It also helps to scale the business faster and more efficient because insights can be generated from the data quickly and cheaply. Therefore, start-ups should consider investments in building up this IT-infrastructure in a professional matter even though resources are limited.

Start-up stage

After successful completion of the seed stage and the market entry, the focus is shifting to growth. The company should focus on generating growth and work towards achieving that goal – so should the controlling system be. Therefore, the controlling must focus on very few key figures that represent the start-up’s purpose and reflect the success of the venture. Those specific key figures also ensure that success or failure can be measured quickly and in often repeated cycles which enables the start up to react in an agile manner depending on the collected data. Start-ups need to measure their realistic status on the way towards their goals and improve by learning how to move these numbers closer to the ideal reflected KPIs. The faster those key figures are assessed, and conclusions are drawn from that, the better. This should be the controlling systems’ contribution to rational decision making. On top of that, in this stage it becomes easier to attract investors for the start-up if well-defined and measured data is available. In addition, the information needs of existing investors needs to be adequately covered. This is particularly important to define the objectives against which the start-up is measured to the investors before they provide financial resources.

Growth stage

Appropriately designed growth controlling creates a stage for setting the right priorities. The controlling system in the growth stage needs to measure the progress that really accelerates the business. Therefore, the controlling needs to provide information, if the implemented changes produce the results the company is expecting and if the management is drawing the right lessons from those changes. Furthermore, after having the first market experience, the KPIs should be continuously readjusted to ensure the highest possible relevance to the current situation. However, it is still crucial to focus on few key figures which are regularly monitored to satisfy the need to react agile, fast, and transparent for all involved stakeholders. Successes and failures must be made transparent to ensure rational decisions. No matter which specific drivers of growth start-up have, a framework that supports accountability and controlling, even when the business model is changing, is necessary. To establish that accountability, the setup of an efficient cost accounting system with standard instruments can be a helpful tool. For example, the setup of cost center structures and cost unit accounting can create transparency and can help linking a market responsibility to a cost responsibility. The intention is to allocate the services and costs incurred in the operational production process to individual periods, company divisions or products. To do this, the internal business transactions must be entered, processed, and evaluated from a business perspective. Based on this, a simple reporting should be established.

The reports need to demonstrate clear cause and effect to the start-ups’ employees so that they can learn from their actions by providing clear and objective assessment. Therefore, the reports must provide a clear overview what works and what has to be changed. Furthermore, the reports must be accessible for the employees and the managers through integrated reports. Since their decisions are reliant on the reports, it is important that the reports are understandable and simplified. The used metrics need to be concrete enough to lead to organizational action. Especially when the company is growing, accessibility is a key requirement. This includes the widespread access to the reports within the start-up. Another important requirement for reports is that they ensure the data is credible to everyone involved. Thus, start-ups need to be able to test the data in the reality to check if the reports contain true information. Especially venture capitalists need few, highly relevant KPIs to understand where there are actual successes or problems and how they can support accordingly. They also need KPIs to provide information to their own investors and to enable them to better assess how the value of their portfolio companies is developing.

Later stage

In the late phase, start-up entrepreneurs often want to continue growing their company or deal with either an exit through the company’s sale, a management buyout, or similar scenarios. The provision of business-relevant information is highly relevant at this stage to shift the business from a start-up to an established company.

To avoid unnecessary effort and inconsistencies, the focus is to harmonize the reporting requirements and automate them as far as possible to ensure continued agility and transparency beyond the start-up status. Seen in many large and established companies, it can be quite expensive and difficult to change inflexible and intransparent structures that have been established over longer periods of time. Therefore, it is important to set the switches for an agile controlling system during this stage at the latest. In companies that excel at this efficiency and agility, one common factor is one central database that contains all relevant information in high quality in combination with an easy and lean IT-system-landscape that avoids all unnecessary satellite systems.

Efficient information flows are essential at this point. With more and more market experience and financing certainty, strategic controlling is now more practicable. This means that planning in this phase can often extend beyond short-term periods and have more strategic components. At this point, the business model is often so mature and proven in practice that the factor of uncertainty becomes smaller, simply because of experience and the amount of collected data. Depending on the company size, the implementation of an ERP-system can be relevant, which should be conducted as standardized as possible and by experts to avoid expensive mistakes.

Start early and small and expand continuously

Start-ups that implement a controlling system have more sustainable success and grow more efficiently and agile. However, many start-ups initially lack necessary financial resources for the fulltime employment of a qualified controller. Nevertheless, a meaningful controlling can already be carried out by the management itself with manageable resources and little time effort. As an alternative, start-ups can use external controlling consultants to setup the structures. Besides cost advantages, this offers the advantage that mostly all relevant specialist topics are covered, and the controlling is implemented professionally.

At DRAXINGER & LENTZ, we can support you in setting up a lean, agile, and fast controlling system no matter in which phase your start-up is in. Through workshops we jointly develop the KPIs relevant to your start-up and ensure that the necessary data is made easily accessible and transparent within your company right from the start. After initial workshops we enable your start-up to realize professional, competitive, and cost-effective structures that support your management and meet the reporting requirements of your investors and partners. Furthermore, we transfer necessary knowledge to you and thus build up your controlling know-how step by step and sustainably. After the initial setup, we can continuously support you to adapt the controlling systems to the needs of your growing company to ensure rational decision making, control and low fixed costs at any time.

For further information about Controlling in startups please contact Fabian Winckler (fabian.winckler@www.draxingerlentz.de) or Marco Lotz (marco.lotz@www.draxingerlentz.de).